Blogs| Methodology, Considerations, and Tax Credit Calculations for LIHTC

Written by

Anuj Pratap

Published

Aug 29, 2024

Topics

LIHTC

The Tax Reform Act 1986 created the LIHTC program and set the overall methodology for calculating tax credits for a LIHTC development project.

However, since each state housing agency (HFA) administers and allocates LIHTC within its state, it maintains oversight on the nuances of LIHTC calculations.

Developers or other applicants must consider many factors when calculating tax credits, such as eligible basis, QCTs, Qualified Basis, and the applicable Tax Credit Rate.

This article unpacks these considerations and illustrates how to calculate annual and total tax credits for a LIHTC project.

Note: This is a complex topic, so this blog post should not be a substitute for professional tax advice.

The applicant requesting LIHTC allocation from the HFA needs to calculate and apply for tax credit when submitting the LIHTC application.

This calculation is important because it directly affects the maximum tax credits reserved for the housing project. The developer can sell these credits to investment funds and individual investors and raise equity for the low-income housing project.

Claiming these tax credits through the project’s lifetime is a separate process, which asset managers handle using LIHTC software.

LIHTC Pricing

LIHTC is usually a popular investment vehicle because it provides dollar-for-dollar return on tax credits earned by the federal government.

However, the actual returns investors earn on their investments in a low-income housing project vary slightly because, in practical terms, the demand for tax credits varies.

Investors earn real returns of around $0.85 to $0.90 on the dollar for every tax credit that they earn. This pricing of tax credits depends on investor demand and is influenced by many factors, like the market demand for tax credits, the current tax rate for corporations, and the CRA ratings that corporations need.

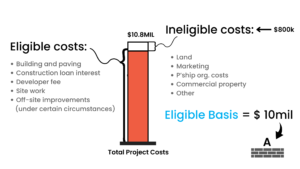

The first item that applicants need to consider when calculating tax credits for a project is the Eligible Basis. The IRS website provides a more detailed explanation in this PDF.

This is the cost of developing a low-income housing project eligible to receive tax credits.

The costs included in the Eligible Basis must be depreciable. These include most construction costs and all costs directly related to the project’s construction.

The Eligible Basis includes the actual payroll cost for people constructing the projects, developer fees, construction raw materials, architect’s fees, engineer’s fees, and the fee for gaining local licenses and building permits.

Ineligible Items

The cost of the land is never included in the Eligible Basis.

The costs not directly related to the construction of the low-income housing project are also ineligible to earn tax credits.

Some examples of costs ineligible to be allocated tax credits are the project’s marketing costs, the cost to set up the partnership managing the project, the fees for managing a syndication fund, or amounts kept as reserves.

Since state HFAs manage and allocate LIHTC, each state can offer an incentive to prioritize some areas for development.

The HFA demarcates such areas as difficult-to-develop (DDA) areas or Qualified Census Tracts (QCT).

These areas are eligible for an increase of up to 30% when calculating their Eligible Basis for an application and are called high-cost adjustments or Basis Boost.

They only apply to the areas the HFA has set aside in its Qualified Allocation Plan (QAP) for the year. The QAP also gives the percentage Basis Boost to apply.

If a developer or an applicant proposes a low-housing development in a QCT, they can apply a basis boost and increase the eligible basis for the project.

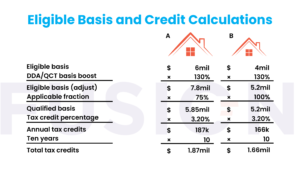

The Adjusted Eligible Basis will thus be the Eligible Basis * the Basis Boost.

The qualified basis is the percentage of the eligible costs that qualify for earning LIHTC. It is directly proportional to the proportion of affordable housing generated by the development.

LIHTC applicants must understand the Applicable Fraction to calculate the qualified basis. The qualified basis is calculated by multiplying the Eligible Basis (or the Adjusted Eligible Basis) by the Applicable Fraction.

Applicable Fraction

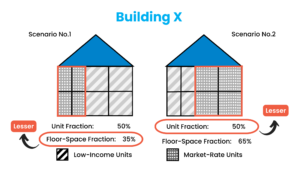

The Applicable Fraction is the amount of the development project explicitly nominated as affordable housing.

If the housing development project has no market-rate units, this will be 100%.

The Applicable Fraction is also called the Minimum Set-Aside, unit fraction, or affordable square footage.

If only a part of the development is reserved for low-income families, then, the Applicable Fraction will be the lesser of:

A minimum set aside of 40-60 means that at least 40% of the housing units in the affordable housing project are reserved for low-income households. The Applicable Fraction will also be 40%.

Low-income families earn less than 30% of the area’s median income.

Under the LIHTC program, the Federal Government allows either a 9% or 4% tax credit. HFAs allocate LIHTC credits depending on the type of development—9% credit for new developments and 4% for renovations.

The 9% credit covers almost 70% of the project’s construction costs. And the 4% credit covers about 30% of the project cost.

The terms 9% and 4% here are identifiers and not the actual rate of tax credits that a project earns.

The actual rate of tax credit earned varies yearly. The IRS sets the nominal rate of tax credit each year and calls them the Applicable Federal Rates (AFR).

For example, in 2024, the IRS set the real tax credit rate at 8.02% for the 9% credit and 3.44% for the 4% credit. See the relevant ruling (look under Section 42).

Once you arrive at these parts, calculating the total rate is simple.

The annual tax credit is the project’s Qualified Basis * the AFR.

The qualified basis multiplied by the tax credit rate is the amount of tax credits the project will earn over its ten-year lifecycle.

So, to get the total tax credit the project will earn over its lifetime, multiply this amount by 10.

LIHTC is a Healthy Ecosystem

If a LIHTC application is approved, the tax credit the project earns is reserved. The applicant is then free to monetize these tax credits to raise equity in the project.

Developers recover their costs, and investors purchase these tax credits to offset their federal tax liability. The relationship between developers and investors in LIHTC is complimentary. It’s a healthy ecosystem that benefits all the stakeholders and the community it serves.